A personal journey towards decentralized organizations

For some reason, I’ve been thinking about autonomous, decentralized organizations since 2013.

Corporations today look exactly the same as the Dutch East India Company: a piece of paper with some rules written on it. There’s no “actual” corporation, as Yuval Noah Harari would say, it’s just a nice shared fiction that we create and believe in.

To create one, you have to spend thousands of dollars on lawyer fees, beg banks to open an account for it, pay tons of taxes, only to get some pieces of paper that only work is a specific jurisdiction!

Corporations have been the core driver of innovation from the industrial revolution till today, and to think that they haven’t evolved at all is just plain crazy.

This essentially means that the amount of innovation in the world today is constrained by these antiquated legal structures.

So, since 2013 I’ve been thinking about how to solve this problem, and this is the story of how this process brought me to Aragon today.

2011

Let’s do a quick detour to the summer of 2011, soon after landing in SF, as I pushed my way into a test day at a small startup few people had heard of at the time. They were not hiring for the role I wanted and didn’t for years to come, but I had a magnetic pull to it.

So I joined 7 or 8 people in a Hacienda-looking cute small house in downtown Palo Alto for a day. Most of them were from MIT and wicked smart. Two were crazy Irish teenage brothers, who had founded it.

The company was Stripe and the feeling I had while being there is the reason this post is starting with this little anecdote, which I’ll come back to later.

2013

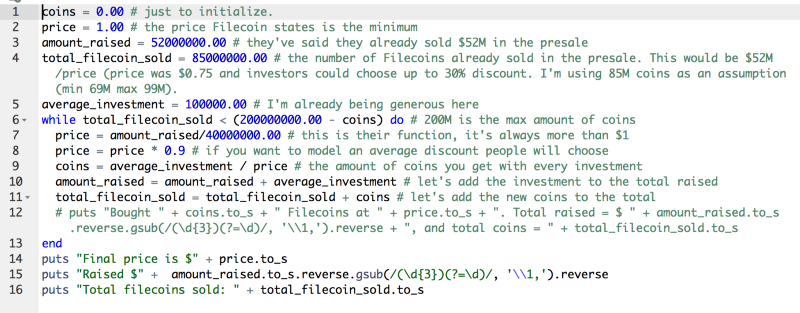

But the real story begins in April 2013, when I opened up a fresh new blank Google Doc and started typing: BitCorp.

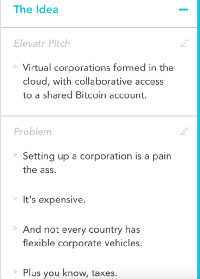

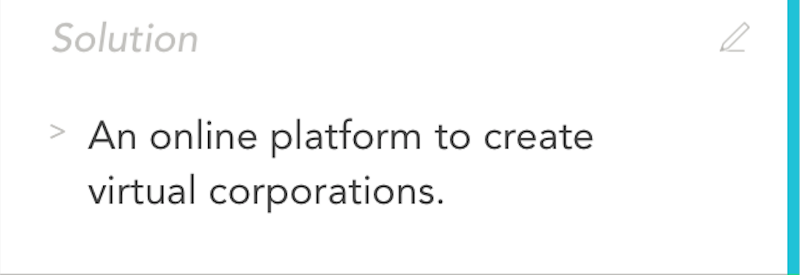

The idea was as simple as it gets:

A new framework for creating modern, anonymous corporations.

BitCorp enables anyone to create a digital corporation, not bound by any sovereign legal and fiscal framework. The corporation’s activities are run in Bitcoin.

The idea came to me because of how hard and expensive it was to create new companies for small projects and collaborations.

This was a period when I was extremely interested in Bitcoin (and had been since 2010) and its future potential both as the default SoV as well as a permissionless financial transaction tool.

The features I had in mind where also very simple:

MVP FEATURES:

- Create a corporation (Decide number of shares, Assign first shares to users, Create roles (CEO, Board Members))

- Hosted company Bitcoin account

- Issue new shares

- Receive investments

- Define voting and control rules (“xx% of common shares votes needed for transactions higher than xx Bitcoins”)

POST MVP features included of approval of enforceable budgets, shares classes and even an IPO Market. Turned out I should have called it an ICO market, but who could have known 🤷.

What wasn’t simple was the implementation of all of this.

This is still 2013, the ideas of Colored Coins and smart contracts are starting to float around, but there is still obviously no Ethereum on the horizon, and even though I had graduated in Computer Engineering, my coding is limited to Rails scaffolded web apps.

This means that my only possible implementation is that of a centralized web app that fundamentally operates around a shared Bitcoin wallet. But centralization, when building things at the edge of old-school regulations, means a guarantee of shutdown or worse.

So, aside from chatting about the idea with a few people in Cafe Centro, I mostly park it.

2015, not quite there yet

A cold email from a fellow Sandboxer makes the idea resurface: this young Argentinian guy wanted to build something very close to my original idea, using the blockchain to time-stamp and proof data, he called it BitCorporations.

The time was still not right yet for this idea to work though, and after a while they decided to abandon the project. Fortunately, they turned all of their work into what today is Zeppelin!

In the meantime, I had participated in the Ethereum pre-sale and saw it go live, but I was running a startup and a small fund at the same time, so couldn’t focus too much on it. But it was clear that it was the future.

2017, discovering Aragon

Fast forward to one day in early 2017, when I discovered Aragon, a project started by a couple of Spanish teenagers who were building exactly what I had in mind, and doing it the proper, decentralized way — with very little regard for the status quo, and a naivety about the scope and difficulty that only young idealists can have.

After following them for a bit, it turned out that Jorge was an incredible developer with a mind wired for decentralized organizations (as can be seen in his early posts) and Luis was an idealistic leader who just couldn’t function in a world run by centralized organizations.

The potential of the team was as clear as it can get.

In May 2017 I participated in their token sale, and continued to be a fan and friend ever since finally meeting Luis live at the first Unplug retreat.

2018, the execution year

This year was quite spectacular for followers of the Aragon project, with continued product shipping, culminating with their recent mainnet release.

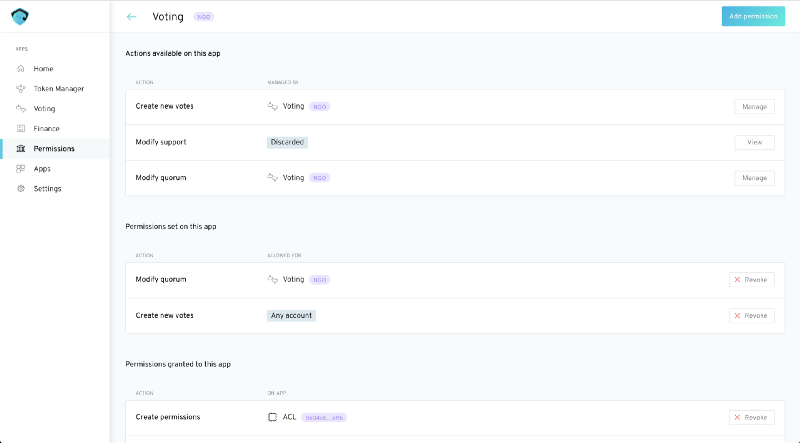

Contemplating the fact that today it’s possible for anyone in the world to spin-up a decentralized organization thanks to aragonOS (a marvel of smart contract engineering) and the Aragon client app, is pretty mind blowing.

There are infinite articles or examples that can be used to explain just why this is one of the highest quality projects I’ve ever seen, but to me, two of the most telling signs of Aragon’s pioneering in this new decentralized world are their extreme transparency focus and their announcement of the decentralization of its development.

Aragon is setting the standard in transparency, with all of its expenses and treasury movements made public as well as a direct view into the treasury wallet at all times.

And it is setting the standard in decentralized governance and development as well. It is the first team to intentionally explode itself into a decentralized network and actively incentivize other teams to collaborate (and maybe even compete in the future) with itself by providing them funding.

Luis and Jorge want Aragon to be around not because it’s their baby, but because it’s important and needs to exist in the world. And I share that feeling.

The future

Back to the 2011 Stripe story: the only time I’ve ever re-lived that 2011 feeling was when I visited the Aragon team in Zug a few weeks ago.

Sitting with Patrick, John, Billy, Greg (who went on to co-found OpenAI) and the rest of the Stripe team, it was clear that they were about to transform the online commerce world and with it unleashing a whole new wave of innovation.

Listening to Luis and Jorge explain the Aragon core infrastructure and what its future looks like felt eerily similar, and I think speaks to the quality and potential of this team.

(I also don’t think it’s a coincidence that Stripe ended up playing in the same space with the launch of Atlas.)

I think that Aragon is one of the most important projects that have come out of the decentralized computing movement in the past few years, with a clear potential to radically transform how people interact, collaborate and transact in the real-world.

In the 21st century it is frankly absurd to be living in a world made of borders and barriers.

I envision a world where people all around the world can collaborate and transact in freedom, where capital is not the chief divinity ruling all of our lives and environments, where we let go of elites and aristocracies and where stupid barriers to progress and innovation are torn down when they stop making sense.

Organizations should be spun up and wound down as needed. They should be extremely flexible, being able to implement any type of governance. They should be global by default and not bound by any rigid legislature.

Anyone, anywhere in the world should be able to spin up a cooperative, corporation, association or any other type of organization and use it to collaborate and transact with other people around the world.

People should be able to do so in low-trust environments, with the guarantee that what’s encoded in the software can’t be changed, and that in certain situations final judgment can be delegated to a 21st century court system.

And as we move towards an AI-infused world, it’s also likely that different AIs and smart objects will need structures to interact with each other.

As you can see, the amount of innovation that Aragon can unleash is limitless.

Helping Aragon for me means helping move the world towards what it should actually have been for a while already, and I couldn’t be more excited to join the Aragon Association as its first Executive Director.

The Aragon Association’s mission is to ensure the development of the Aragon Network. Specifically, this means managing its treasury and funding teams to build out the core parts of the ecosystem.

We already have two teams building on it, and are looking for more.

You can think of this role as a temporary overseeing of the Association’s activities and treasury, while we figure out how to render it completely irrelevant (like every other physical jurisdiction-bound paper-based legal entity) and transition all of the governance to the Aragon Network itself.

I will be hiring a small team to make sure all of this happens, so if you are as excited as I am about the potential for decentralized organizations, you should reach out.

Additionally, we are organizing the first ever Aracon in Berlin in January, and that’s the perfect place to come learn about how organizations will work in the future and what you can build with Aragon today.

Transparency disclosures: I own ANT from the original token sale, which I never touched. I will be receiving a (small) amount of ANT as part of this new role, and I have also been buying some ANT off the market recently.

I will continue my investing activities, which include investing in European venture capital funds for a family office; in impact deals as an angel investor; and in in teams building the future of decentralized computing through Semantic Ventures as a venture partner and advisor.

I will also continue writing Token Economy and organizing Unplug.vc events.