Digging into the dynamics of Filecoin’s token sale and economy

Filecoin could be a game changer for the crypto space. It’s one of the few projects that are extremely well thought out, built by an amazing team, and actually needed.

Add to that the fact that they created a new proof mechanism and have a legitimate need for a blockchain.

In other words, it’s probably the best that the crypto community has seen recently. It was certainly one of the few ones I was looking forward to.

But then, two things happened:

- they released some info on the token sale.

- they released some more info in response to anonymous questions from an investor.

Man, I wouldn’t have expected something like this from a solid team. The response felt particularly disingenuous.

I’m now incredibly disappointed, and probably will not participate in the sale.

I’ll also probably lose a good number of friends that are investors in the company and/or pre-sale, but in this new era of completely public fundraising, I think the public deserves to hear it from all sides.

The flaws in Filecoin’s token sale

- Filecoin gave an amazing deal to their buddies, just a few weeks ago

- Filecoin is being insanely greedy, going out for a $700M+ raise

- Early clickers are incentivized, price unknown, network congestion update, see below

- Protocol Labs and Filecoin foundation are keeping 2x the coins that investors will get

Problem #1: Filecoin gave an amazing deal to their buddies

There’s nothing that can stop them here, but many people got very mad about this and rightly so.

Filecoin raised $52M in an advisor sale very recently, till July 24th. This sale was reserved for people close to the company and in the industry. Many extremely high profile people participated, total cheques were 150.

These investors paid a maximum of $0.75 per coin. They could also have chosen discounts based on the amount of time the coin would vest, from 0% to 30%.

These investors did not take any more risk than the investors who are going to participate in the public token sale. Actually, one could argue that they even took less risk because they knew what the price would be all the time (which is not going to be the case for public investors)

Their explanation:

All of these people and organizations (a) have been working hard with us for years to make IPFS and Filecoin successful

This is absolutely untrue. Quite a few people just got introduced to the team recently and got into the sale just a week ago and paid the $0.75 price.

(b) have fully committed themselves to work hard with us and for the Filecoin Network for many years to come,

Sure, but you, dear reader, would commit too, wouldn’t you?

c) offer tremendously valuable advice, hands-on help, knowledge, skills, resources, connections, and more.

This is the real reason that they will pay 2x-20x less than you. You be the judge. Usually vested equity is subject to good behavior, but here anyone could promise great advice and help and then disappear, but still get coins.

Problem #2: Filecoin is being insanely greedy

After having raised $52M in a pre-sale for a pre-product offering, they want to go out and raise an amount that is effectively uncapped.

Their response:

Our token sale IS NOT uncapped. It is capped in terms of the amount of Filecoin sold: 200M FIL.

Over the last few years, Protocol Labs has proved to the world that we know how to deploy capital to create valuable projects, valuable technology, and valuable software. To date, all of the work you see — IPFS, libp2p, IPLD, Multiformats, Filecoin, CoinList, and all our research — all our work has been funded by under $3.5M. We know how to deploy capital effectively.

It seems like I’m reading a Trump statement. Basically saying: “I have eaten 10 ice creams in the past years, so I’m great at eating ice creams and can easily eat 1000 in the next few years. Gimme ice creams.”

But aside from the absurdity of trusting someone that deployed $3.5M with $500M+, let’s analyze the USD cap of their token sale.

Some numbers

- $52M raised in presale

- Minimum 69M, Maximum 99M Filecoins sold in ICO

- Advisor max price $0.75

- 131M-101M Filecoins left for the public

- Starting ICO price: $1.3 ($52M/40M), almost 2x advisor price.

- Price at $100M raised = $2.5

- Price at $200M raised = $5

- Unfortunately, their price function is not clear. It doesn’t state if a transaction amount impacts the total raised before calculation of price or after. In any case, assuming normal average investments, eg. $100k, this doesn’t change much.

- The USD cap will change based on the average purchase amount and the average discount chosen by the buyers.

Let’s calculate the Filecoin ICO USD cap

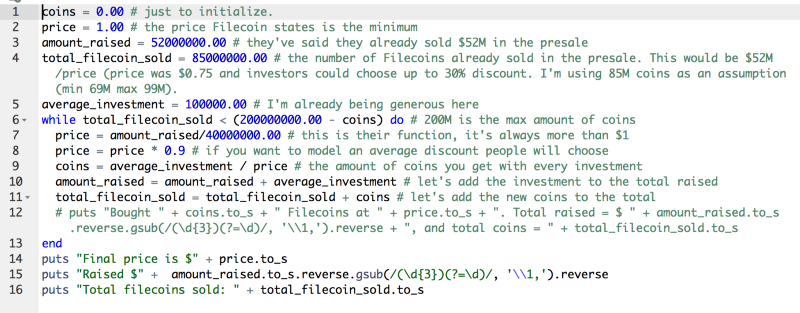

I wrote a small piece of code to calculate the USD raised with different assumptions.

You can see it here:

https://gist.github.com/stefanobernardi/d6eda1fb299d0832c3dad71a5a4fcd20

And you can run it here on the amazing Repl.it (Mission and Market portfolio company plug! Oh BTW, I deployed $3M with my first fund, maybe I should raise a $1B second fund.)

Assumptions:

- Total Filecoin sold in the advisor pre-sale: 85M (The minimum sold is 69M, if everyone paid $0.75, and the max is 99M, if everyone chose a 30% discount, so I chose something in between)

- Average investment = $100,000.00

- Average discount chosen by investors: 10% (discounts are 0%, 7.5% for 1y vesting, 15% for 2y vesting, 20% for 3y vesting — I’m assuming many will choose 0 and a few will choose the rest, so 10% sounds about ok.)

The results

Final price is $15.54075

Raised $690,800,000.0

Total filecoins sold: 199999826.3440984

So effectively the cap of Filecoin’s ICO is ~$700M.

For fun, let’s assume no one chooses discounts:

Final price is $34.34

Raised $1,373,700,000.0

Total filecoins sold: 199997793.51623443

The real cap is $1.37B.

And, everyone max discount:

Final price is $7.83

Raised $391,600,000.0

Total filecoins sold: 199991567.59900582

Highly unlikely, but this is the minimum possible cap.

Call me old fashioned, but wanting to raise half a billion dollars for a pre-product endeavor is absolutely fucking insane.

Let’s remember that the tokens will also come out when the network is launched, which Protocol Labs is estimating at 1 year out. Vesting will only start then.

Problem #3: Early clickers are incentivized, price unknown

Given the price grows as more money is invested, early clickers are incentivized to get in as fast as possible — this has the obvious intention of raising as much money as possible.

Users paying in BTC and ETH will also have to wait for their transactions to confirm before knowing how much they paid. Given a very likely clogging of the network, this has the potential for disaster.

I suggest reading their explanation in the response. It is a mix of funny and scary.

Update: rules have changed. Price will be averaged in the first hour and max price in the first hour is $6.

This means that no one will pay the $1.31 min price and buyers in the first hour won’t know how much they’ll pay in the $1.31-$6 bracket.

When the first hour is over, that’s when people will want to fast click because they’ll have information about the price and total raise.

This update just makes it so that there won’t be any price difference for first hour clickers, which is good, but not great. Price is still unknown (and crazy high compared to advisors).

Problem #4: Protocol Labs and Filecoin foundation are keeping 2x the coins that investors will get

This is absolutely mind-boggling to me.

To compare, the ETH genesis sale gave 10% of ETH minted to early contributors and 10% to the Ethereum foundation. 80% was for investors.

In Filecoin’s case, Protocol Labs will receive all the cash PLUS 50% more coins than investors, so 1.5x. A foundation will receive 50% of the amount of coins “minted” by investors. Total: 66.6% to them, 33.3% to you.

Assuming a “small” $250M total raise, Protocol Labs and a foundation would receive, $250M cash, plus $250M-$300M (remember, the discounts?) in tokens.

Also, 70% of the tokens that will ever exist will be mined. This means that the investors are only getting access to 10% of the total supply ever.

As a comparison, Ethereum sold 60,108,506.26 ether at genesis, and today there are 93,775,666.

Place your bets accordingly.

…

Quick and dirty utility value calculation

Edit: I’m removing this as apparently it was way off. I’ll try to spend more time, but with token sale in just a few days not sure I’ll be able to, so prefer to just take it off.

All other points I still stand by.

Conclusion

Filecoin is why we can’t have nice things.

A real game changing project, that has always touted they care about the community and would do this for free, is going out trying to raise $700M and keeping double that in coins.

I think this could be one that will be remembered and written in history books about how insane this all was, and how a major innovation like the cryptographic token was taken advantage by people wanting to raise stupid sums of money, before it was really used to the best of its potential.

Thanks to redacted, redacted, redacted, redacted, and redacted for providing feedback on this draft, the ideas behind it, the code and the assumptions for the utility value.