I’ve launched a new venture fund investing in unruly founders. Read the launch manifesto here!

1 year of Planet+ angel investing

In October 2018, I had the honor of joining the angel programme of the largest European venture fund.

I was therefore tasked with figuring out how to think about allocating the $100,000 entrusted to me by the fine folks at Atomico.

It turned out an easy exercise:

When we raised Mission and Market in 2014-15, we kept the most generalist investment attitude and thesis possible. This made sense as it was our first foray into investing, and we ended up with some wildly different portfolio companies: consumer and real estate, saas and deeptech, marjiuana and crypto, cancer treatments and smelling chips.

I understood fairly quickly that the companies that made me more excited were the ones doing what most would now define as deep-tech: synthetic biology and deep learning form a pretty big part of the portfolio.

But I also quickly realized that there was an underlying, maybe subconscious theme underlying my investments towards the end of the investment period of the fund: finding companies actually “making the world a better place” (for lack of a better phrase, as that’s one you’re bombarded with if you live in San Francisco, and one you can become completely numb to after having heard it used by companies creating flavored water, data analytics or a new DTC brand).

At the same time I started waking up to the vastness of the climate crisis, ecosystem degradation, soil health, water scarcity, lost appreciation for nature and biodiversity loss problems – and started wondering why every single investor was not already focusing on this, as it’s clearly the paramount problem to solve in the world.

Everything else doesn’t matter if we don’t have a planet.

So an investment thesis was born: I would only focus on Planet+ companies (and I promise a more in depth investment thesis post soon).

I could already classify some of my Mission and Market portfolio as Planet+

- Clara Foods: ending factory farming.

- We’ve been some of the earliest investors in Arturo and team since the seed stage. Producing brewed egg-white proteins from yeast is one of those ideas that immediately made it clear how the future would look like: one in which we didn’t have to imprison and torture billions of sentient creatures, and grind baby chicks to produce food, while at the same time having a massive environmental impact.

- Aspiration: transformational finance.

- Investing in a challenger bank still felt pretty crazy at the time, but Aspiration is once again a glimpse into the future, a vision of what banks should and will be: putting your money to work towards the common good, not the interest of the bankers.

- Vitrolabs: ending factory farming.

- Growing animals for their meat and leather is so medieval and inefficient, it still makes me incredulous we are not all working for alternatives. Vitrolabs creates in-vitro cell-based leather, a superior and much more environmentally friendly product.

and had invested in dozens of Planet+ deals on AngelList including drones for reforestation, cell-based fish, energy storage providers, turnkey net-zero energy homes, advanced energy storage devices and more

so that gave me the baseline of network to work with, but I was still pretty green to it.

My Planet+ angel portfolio

I spoke with countless amazing companies building solutions to save our planet, and ended up investing in four (with one more to close soon).

I can only share one name, but will publish specific investment posts when the companies announce their funding

- 🇺🇸 Pachama: reforestation

- Pachama is a company started by my W15 batchmate Diego, who is using satellite data and drone images to efficiently verify carbon capture by reforestation projects. Reforestation is one of the big solutions we must push for in order to restore degraded ecosystems, fix water patters and try to mitigate the impact of climate change.

- I was honored to be joined by Chris Sacca, Paul Graham and other legendary investors in backing Diego.

- 🇪🇺 Insect proteins for fish and animal feed: sustainable agriculture

- Getting fishmeal and soy are two of the most destructive practices in agriculture today, and they are the main sources of proteins for farmed animals. Getting the same proteins from insects is a wildly more efficient and sustainable solution.

- 🇪🇺 Fermented mycelium proteins: end of factory farming

- The quest to find the best alternative proteins on which to feed the planet is already on, with plant-based and cell-based meats, but one I think holds a particular potential is to be found in the realm of fungi. This company uses the roots of fungi to ferment a protein that is the most sustainable of all the meat alternatives yet developed.

- 🇪🇺 Mobile-first, millennial-targeted impact investment platform: transformational finance

- Directing capital towards important topics and companies is one of the highest leverage activities we can focus on. It is mind-blowing the amount of capital invested in random companies destroying our planet – and climate change will make it shift so fast, it will be incredibile to watch.

As I met with amazing founders doing important things, I couldn’t resist wanting to deploy more capital, and thus ended up investing in three more companies with my personal capital, as my first real “angel-sized” investments.

- 🇪🇺 Mid-range, fully electric airplanes: transportation

- We all know we have to move most of our transportation to electric. The hardest is airplanes, for obvious reasons. While there is no solution in sight for long-range flights, we have the technology for some lower distance routes.

- 🇪🇺 Molten salt nuclear reactors: energy

- The consensus is clear: in the mix of energy sources for the near-future, we will need nuclear. We’ll need existing plants, new plants with existing tech, but most importantly we need to figure out new types of nuclear technologies. One option is fusion, and another one is safer nuclear with molten salt: this would be safe, decentralized, cheap and scalable. The holy grail.

- 🇺🇸 AI prospecting tool for hydro, solar and wind farms: energy, data/efficiency

- Getting more renewable plants out there, and lowering the cost of their projects should be one of the world’s #1 priorities. This company will contribute substantially to that goal.

What’s next?

Interacting with Planet+ founders has made it clear to me that this is my type of crowd.

At the same time, I’ve been completely baffled by the lack of investments in this area by the rest of the venture community. I’d honestly have expected most funds to ramp up substantially their funding to climate-related technologies by now, but that doesn’t seem to be happening.

Therefore, it’s clear to me that spending more time on this area would be a good use of my time.

If you are interested in any of the above companies, or on the thesis in general, I’d love to have a chat.

On seed rounds valuations

Valuations on seed rounds are a timeless debate.

Every 6 months at YC Demo Day time the debate gets reignited given the average YC company raises at a pretty vertiginous valuation.

As usual, a tweet sparked it all:

Ilan introduces the debate from the founder’s perspective: if you are raising a seed round at a $15-20M cap (which if pre-money, means a $25+ post most of the time), Ilan’s argument is that it dramatically increases the difficulty of raising a Series A or Seed extension at a higher valuation.

Should you maximize the valuation when raising a seed round?

That’s the question every founder asks himself. Well, not everyone: some just go straight for the highest val possible.

There is a whole LOT of advice online, but the survivorship bias present in all of the advice received from both founders and investors doesn’t really help making the decision.

The way I like to think about it is in the framework of upside maximization and downside minimization.

If everything goes amazingly with your company and product during the seed phase, then obviously having maximized the valuation will result in the lowest possible dilution.

But, if things don’t go that well, and let’s face it – things never go that well, and the road to Series A will be a tad longer, then having a super high val starts to become a truly existential issue for the company.

I’ve raised two seed rounds on the entrepreneurial side, both very large and both at steep valuations, and I’ve regretted both of them.

Raising 2.5-3M on a $15M cap, means that you’re already at a $18M post. If it takes you a bit longer to find product market fit or prove the metrics that are needed for a Series A, then you’ll have to do a seed extension (second seed, seed +, bridge, whatever your preferred naming is) – and things get ugly very fast there, for both the entrepreneur and the investor.

So at that point you have three choices:

- Extend the seed at the same valuation. This sounds easy enough but there’s a number of problems:

- raising at the same valuation of 2 years prior is never a great sign, for previous nor prospective investors

- the dilution hit will be significant, as it’s essentially doubling the amount of the initial seed raise

- and on top of that, a $18-20M post is still steep for a company that hasn’t proven itself!

- Raising at a lower valuation: this is basically a no-go

- Swinging for the fences and trying to do a seed+ at a slightly higher valuation:

- not everyone will be able to achieve this

- the problems of the first point all mostly stand, especially the new even steeper val

Note: YC has recently introduced post-money SAFEs which should solve this aspect, but the point on dilution stands.

So essentially as a founder, you have a bit of extra equity to gain if all goes well, but you’re essentially gambling the company away for it, because if something doesn’t go to plan, those three options up here aren’t all that desirable.

Should you care about pricing when investing?

Soon into the debate, Garry Tan weirdly enough missed the whole point of it all and switched it completely towards the investors side.

Felt really weird, but now we’re here. And pricing is one of the most interesting debates going on in venture investing – and one where you usually find two very opposite camps.

The argument for price insensitivity

As you can see, the YC camp is firmly in the “price doesn’t matter” camp. For the YC-school thinkers, the power laws of venture capital make it so that getting into the right company at a high price will dwarf the returns of getting into an average company at the right price.

Essentially, the only thing you should really care is finding, and getting into that unicorn.

They make it sound like it’s the most obvious thing, but the reality is way more nuanced.

The first thing to realize are the incentives: YC, until recently, used to get a ridiculous $300k post valuation (they invested 20k for 6.06% common stock, and the $100k at $10M post for 1% actually came from a YCVC fund with other investors). (I don’t know the structure of the new $150k deal).

And then, when you look, the people that tell you this, all got into their best deals at extremely cheap pricing. The first round for Twitter, Uber and so on, where all on single-digit post valuations, something that rarely even happens again now.

But the argument usually goes: getting into Uber at $5 post or $20 post doesn’t really matter, the important is getting it.

But the reality is that it does matter. The difference is a 4x return.

Some quick venture math

So say that you have a $30M fund ($25M investable after fees, 20 $500k checks and $15M follow ons)

Your $500k check. At $5M post, you’re getting a solid 10% of a company. At $20M post, you’re getting 2.5%.

Skipping pro-rata math for simplicity, and assuming a solid 70% dilution before exit (option pools and other investors do take a lot of space on the cap-table), you will be left with a 3% or .75% depending on the post valuation you invested in.

This means, that to return your fund twice over, the first investment requires a $1B exit, and the second one a whooping $4B. A $15M difference in cap at seed means $3B plus in difference at exit (or $30B, if we’re talking about a $10B vs $40B exit).

This simple math makes it clear to me that both camps are right: if you get an Uber / [insert other ginormous decacorn here] then you will be just fine.

But it’s also clear that raising the post-val meaningfully raises the stakes.

First of all, even in a decacorn-like situation, you’re returning a fraction of the capital you would have at a lower valuation.

But more importantly: not everyone will get a decacorn in their portfolio.

Imagine getting a company you backed at the seed round with one of the leading seed checks in the deal achieve a $1B exit (and there are only 10-20 every year in the US), which would make you one of the top investors in the country, but returning just a quarter of your fund on it. ($1B*.75% = $7.5M)

In my book, that would be a pretty miserable failure.

So: if you are extremely confident that you will find your decacorn, then by all means, investing at $20M pre is fair game. But, if like most investors, you think that already finding one $Billion dollar outcome in your fund would be a success, then being disciplined on pricing is a must-have attitude.

Why 2019 Will Be The Year Of The DAO

6 Trends Likely To Drive Experimentation With Decentralized Organizations

We’ll be talking about this and much more at AraCon, the Aragon community’s first ever large event happening in Berlin at the end of this month.

Introduction

One story in crypto is the price story — how speculative investments in cryptoassets are performing. In 2018, that story wasn’t so positive, seeing a massive return to earth after 2017’s run up broke gravity.

Another part of the crypto story, however, is the evolution of the underlying tech stack. Still another is the broader global social context that creates a need for those decentralized, censorship-resistant technologies. In those contexts, 2018 tells a very different story.

At Aragon, we sit at an interesting vantage point, not only developing technology but getting to watch as hundreds of projects and organizations start to build on top of that technology. From where we sit, 2019 is poised to be the year of the DAO. Here’s why.

DAOs: What Are They Good For?

First, by way of set up, let’s quickly review some of the characteristics of decentralized organizations and the use cases that those characteristics suit them for.

Decentralized organizations are good at:

- Coordinating resources when not all parties know one another (or don’t know each other well enough to trust one another deeply)

- Aligning large numbers of stakeholder contributions towards shared goals

- Running organizations in a way that is resistant to censorship

- Tracking and validating participation and contribution to a project

- Accommodating a variety of levels of contribution

- Allowing people and entities to contribute work in a jurisdiction-agnostic fashion, regardless of the rules of the physical location where they’re contributing from

- Nimble setup, especially relative to traditional organization structures

This set of characteristics lend themselves to huge numbers of possible use cases, but a few broad categories that stand out as most relevant are:

Businesses constrained by the existing system, in terms of things like complication around the nature of contributions (i.e. difficulty of fitting people in the box of employee, contractor, etc); jurisdictional issues (i.e. the challenge of operating globally in anything resembling an efficient manner); or regulatory issues — which doesn’t necessarily mean that the business is doing something nefarious, but more that regulation in its jurisdiction hasn’t caught up yet.

Social and political movements that have a mismatch between their reality — which can be highly dynamic, temporary, and built around small diverse actions from a wide variety of contributors — and the organizational forms available to them, which tend to assume long-term existence, similarity of contribution, and fixedness of purpose over time.

Networks such as online communities that start as informal but who wish to be able to coordinate more formal, tangible action.

Global Trends Incentivizing DAOs

Once we understand what DAOs are useful for and what types of organizations they tend to beget, the next question becomes what are the global macro trends that would lead people to want to build those types of organizations or have those types of use cases? A set of trends stand out.

Globalization Of Talent & Transformation Of “Work”

There are actually many dimensions of how global work is changing but two stand out as it relates to the emergence of DAOs. The first is that talent is more global than it has ever been. As businesses try to recruit that talent, they face massive jurisdictional and regulatory headaches as the current legal system was not organized to accommodate transnational workers. This creates a major financial incentive to organize global work differently.

Another dimension of the changes in work is the nature of what work itself is. In the industrial era and even so far in the information era, “work” has still largely fallen under employment or contract buckets. But what happens when units of work are micro contributions of time, data, processing power etc that don’t fit in any previous legal framework? As new decentralized digital infrastructure is being built, it is exactly these types of “work” that are coming to the fore. New types of work require new modes of organization.

Well-Resourced Stakeholder Networks Needing Coordination

The last few years saw significant financial resources flow into decentralized, open source project ecosystems. These ecosystems promise a different way of doing business to their contributors, including more transparency and even stakeholder empowerment around how those funds are used. These sort of stakeholder-driven communities already need tools for coordination, and this need is significantly increased when those communities are charged with allocating millions of dollars.

Emergence of Decentralized Finance

One of the most important growth and usage stories in crypto last year was the emergence of open, decentralized finance protocols. Today, hundreds of millions of dollars are locked up in permissionless loans and collateralized debt products that simply couldn’t have existed a few years ago. These decentralized finance tools are creating entirely new categories of business opportunity. At the same time, however, these opportunities exist in a total regulatory gray area, so many are turning to DAOs as a sandbox to experiment outside of traditional organization models.

Normalization Of Participation In Governance

People’s expectations are shaped by what is normal and familiar to them. In line with the growth in resources for open source stakeholder communities, there is also a growing belief that stakeholders should have a hand in guiding the decision making of those communities. As governance experiments both on-chain and off-chain become commonplace, the net aggregate impact is the normalization of participation. In other words, the more people are invited to participate in decision making around the communities they belong to, the more they come to expect that right. This creates motivation for organizations to have systems to incorporate the voices and perspectives of their stakeholders in a more direct and routine way.

Deplatforming Grows As An Issue

For much of the young history of Web3, questions of censorship of centralized social platforms were more theoretical than real. We understood, increasingly, that we had lost control of our data, with its own set of consequences, but there wasn’t yet much evidence of platforms asserting editorial control over who could and couldn’t participate. Early in 2019, however, deplatforming has emerged as a more significant issue, with numerous theoretically uncensorable alternatives to social media and fundraising platforms emerging. Whether this is a real issue or a political football and feigned controversy remains to be seen. However, what’s for sure is that a number of prominent voices are using their bully pulpits to put it in the spotlight.

Upswing In Political/Social Organization

The last few years have seen a decided upswing in global social and political action. Importantly, this is not just a phenomena of the developing world, but is sweeping the Global West as well. From Brexit in the UK to the election of Donald Trump in the US to the #MeToo movement to the Yellow Vests in France, the world is heaving. As discontent rises, people are looking for ways to channel that frustration into action. It seems likely that as better coordination tools become available, they’ll find a ready audience with those who want to transform the world around them, and don’t have time to wait for bureaucratic organizations to catch up.

Putting it all together

If these trends are driving interest in and need for DAOs, the next question is who is creating the technology infrastructure to actually experiment with new forms of organization?

While it is still very early days, 2019 is kicking off with significant energy in this direction, including dedicated DAO platforms, applications built for those ecosystems, and even protocols experimenting with decentralized governance.

When it comes to new forms of work and organizations, in many ways the entire blockchain space is an experiment, as mining, validating, staking etc all represent new forms of work that are absolutely vital but quite new. The large and growing conversation around “generalized mining” is reshaping how we think about organizing businesses around these types of work.

Other examples of projects playing in the sandbox of new forms of working include Gitcoin, which allows the open source community to incentivize and monetize their work; Espresso, a decentralized datastore that integrates with aragonOS to let DAO teams share files without relying on Dropbox or Google Drive; and Planning Suite, another Aragon app offering a collaborative planning model enabling multiple different groups of stakeholders within an open source or decentralized organization to coordinate the use of shared resources. Finally, one of the most interesting projects in this space is Pando, which actually transforms creative projects that have multiple collaborators — from books to music to video games — into DAOs.

With regard to stakeholder networks needing coordination, there are a number of projects at varying levels of development. Giveth, for example, is creating an architecture for Decentralized Altruistic Communities, an alternative to traditional nonprofits that allow people to organize around causes and collaborate to allocate resources. Another buzzy-but-not-yet-launched project in the space is Moloch, an open source approach to allow communities to fund shared infrastructure, with more information purportedly coming at ETHDenver in February.

Examples in the Decentralized Finance space are incredibly numerous. MakerDAO is an increasingly important piece of the puzzle, with more than 1.75% of ETH locked as collateral in Collateralized Debt Positions of CDPs. Compound Finance allows token holders to earn interest on their tokens. Dharma is building a protocol for credit on blockchains that can support numerous types of lending products. In short, DeFi is one of the most exciting areas pushing the boundaries of how you can reimagine organizational structures even in key market activities.

In the realm of governance, 2019 is posed to see a Cambrian explosion of experimental governance models move from theory to practice. 0x is in the midst of a transition to community governance. At the end of last year Melon unveiled more about its proposed governance approach. These represent just some of the approaches that will allow us to learn and see how decentralized governance works in practice this year.

Deplatforming is also in an interesting trend as it relates to real action. There are, of course, some prominent alternatives to incumbent social networks — such as Gab and Mastodon both trying to create alternatives to Twitter. More recently, there have been some announcements about projects that seek to replace Patreon and Kickstarter. And just in the last week or two, 0xchan was announced, which includes developers who worked on POWH3D. In short, it should be an interesting year for decentralized alternatives to social media and funding platforms.

Finally, when it comes to political and social organizations, the use of DAOs remains to be seen. There are some projects working on infrastructure, like Giveth mentioned above. The exciting thing to see, however, will be whether emergent political and social organizations in the numerous relevant contexts around the world, from Rojava in Syria to the 2020 US election cycle to the Venezuelan crypto community, will turn to tools like Aragon and the apps in its ecosystem as they come online.

In short, when you look at both the trends pointing in their direction and the infrastructure around DAOs that is quickly coming online, it’s hard not to be excited about the possibilities for the year(s) to come.

If you’re interested in these topics, we encourage you to check out AraCon, the Aragon community’s first ever large event happening in Berlin at the end of this month.

Thanks to John Light, Nathaniel Whittemore, Luis Cuende, Lucija Matic for the many inputs.

Decentralized organizations are the future: why I’m joining Aragon

A personal journey towards decentralized organizations

For some reason, I’ve been thinking about autonomous, decentralized organizations since 2013.

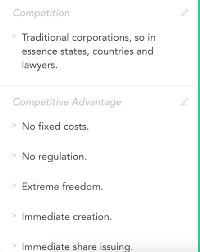

Corporations today look exactly the same as the Dutch East India Company: a piece of paper with some rules written on it. There’s no “actual” corporation, as Yuval Noah Harari would say, it’s just a nice shared fiction that we create and believe in.

To create one, you have to spend thousands of dollars on lawyer fees, beg banks to open an account for it, pay tons of taxes, only to get some pieces of paper that only work is a specific jurisdiction!

Corporations have been the core driver of innovation from the industrial revolution till today, and to think that they haven’t evolved at all is just plain crazy.

This essentially means that the amount of innovation in the world today is constrained by these antiquated legal structures.

So, since 2013 I’ve been thinking about how to solve this problem, and this is the story of how this process brought me to Aragon today.

2011

Let’s do a quick detour to the summer of 2011, soon after landing in SF, as I pushed my way into a test day at a small startup few people had heard of at the time. They were not hiring for the role I wanted and didn’t for years to come, but I had a magnetic pull to it.

So I joined 7 or 8 people in a Hacienda-looking cute small house in downtown Palo Alto for a day. Most of them were from MIT and wicked smart. Two were crazy Irish teenage brothers, who had founded it.

The company was Stripe and the feeling I had while being there is the reason this post is starting with this little anecdote, which I’ll come back to later.

2013

But the real story begins in April 2013, when I opened up a fresh new blank Google Doc and started typing: BitCorp.

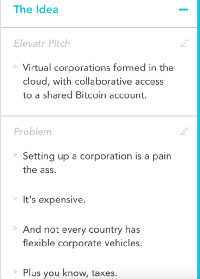

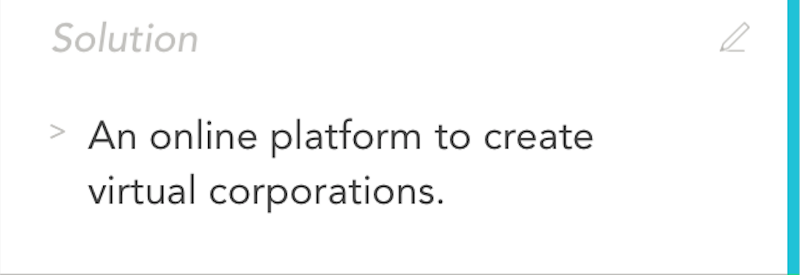

The idea was as simple as it gets:

A new framework for creating modern, anonymous corporations.

BitCorp enables anyone to create a digital corporation, not bound by any sovereign legal and fiscal framework. The corporation’s activities are run in Bitcoin.

The idea came to me because of how hard and expensive it was to create new companies for small projects and collaborations.

This was a period when I was extremely interested in Bitcoin (and had been since 2010) and its future potential both as the default SoV as well as a permissionless financial transaction tool.

The features I had in mind where also very simple:

MVP FEATURES:

- Create a corporation (Decide number of shares, Assign first shares to users, Create roles (CEO, Board Members))

- Hosted company Bitcoin account

- Issue new shares

- Receive investments

- Define voting and control rules (“xx% of common shares votes needed for transactions higher than xx Bitcoins”)

POST MVP features included of approval of enforceable budgets, shares classes and even an IPO Market. Turned out I should have called it an ICO market, but who could have known 🤷.

What wasn’t simple was the implementation of all of this.

This is still 2013, the ideas of Colored Coins and smart contracts are starting to float around, but there is still obviously no Ethereum on the horizon, and even though I had graduated in Computer Engineering, my coding is limited to Rails scaffolded web apps.

This means that my only possible implementation is that of a centralized web app that fundamentally operates around a shared Bitcoin wallet. But centralization, when building things at the edge of old-school regulations, means a guarantee of shutdown or worse.

So, aside from chatting about the idea with a few people in Cafe Centro, I mostly park it.

2015, not quite there yet

A cold email from a fellow Sandboxer makes the idea resurface: this young Argentinian guy wanted to build something very close to my original idea, using the blockchain to time-stamp and proof data, he called it BitCorporations.

The time was still not right yet for this idea to work though, and after a while they decided to abandon the project. Fortunately, they turned all of their work into what today is Zeppelin!

In the meantime, I had participated in the Ethereum pre-sale and saw it go live, but I was running a startup and a small fund at the same time, so couldn’t focus too much on it. But it was clear that it was the future.

2017, discovering Aragon

Fast forward to one day in early 2017, when I discovered Aragon, a project started by a couple of Spanish teenagers who were building exactly what I had in mind, and doing it the proper, decentralized way — with very little regard for the status quo, and a naivety about the scope and difficulty that only young idealists can have.

After following them for a bit, it turned out that Jorge was an incredible developer with a mind wired for decentralized organizations (as can be seen in his early posts) and Luis was an idealistic leader who just couldn’t function in a world run by centralized organizations.

The potential of the team was as clear as it can get.

In May 2017 I participated in their token sale, and continued to be a fan and friend ever since finally meeting Luis live at the first Unplug retreat.

2018, the execution year

This year was quite spectacular for followers of the Aragon project, with continued product shipping, culminating with their recent mainnet release.

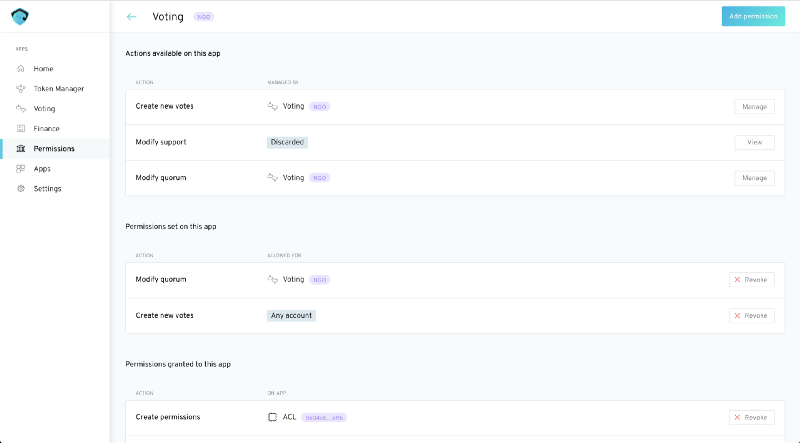

Contemplating the fact that today it’s possible for anyone in the world to spin-up a decentralized organization thanks to aragonOS (a marvel of smart contract engineering) and the Aragon client app, is pretty mind blowing.

There are infinite articles or examples that can be used to explain just why this is one of the highest quality projects I’ve ever seen, but to me, two of the most telling signs of Aragon’s pioneering in this new decentralized world are their extreme transparency focus and their announcement of the decentralization of its development.

Aragon is setting the standard in transparency, with all of its expenses and treasury movements made public as well as a direct view into the treasury wallet at all times.

And it is setting the standard in decentralized governance and development as well. It is the first team to intentionally explode itself into a decentralized network and actively incentivize other teams to collaborate (and maybe even compete in the future) with itself by providing them funding.

Luis and Jorge want Aragon to be around not because it’s their baby, but because it’s important and needs to exist in the world. And I share that feeling.

The future

Back to the 2011 Stripe story: the only time I’ve ever re-lived that 2011 feeling was when I visited the Aragon team in Zug a few weeks ago.

Sitting with Patrick, John, Billy, Greg (who went on to co-found OpenAI) and the rest of the Stripe team, it was clear that they were about to transform the online commerce world and with it unleashing a whole new wave of innovation.

Listening to Luis and Jorge explain the Aragon core infrastructure and what its future looks like felt eerily similar, and I think speaks to the quality and potential of this team.

(I also don’t think it’s a coincidence that Stripe ended up playing in the same space with the launch of Atlas.)

I think that Aragon is one of the most important projects that have come out of the decentralized computing movement in the past few years, with a clear potential to radically transform how people interact, collaborate and transact in the real-world.

In the 21st century it is frankly absurd to be living in a world made of borders and barriers.

I envision a world where people all around the world can collaborate and transact in freedom, where capital is not the chief divinity ruling all of our lives and environments, where we let go of elites and aristocracies and where stupid barriers to progress and innovation are torn down when they stop making sense.

Organizations should be spun up and wound down as needed. They should be extremely flexible, being able to implement any type of governance. They should be global by default and not bound by any rigid legislature.

Anyone, anywhere in the world should be able to spin up a cooperative, corporation, association or any other type of organization and use it to collaborate and transact with other people around the world.

People should be able to do so in low-trust environments, with the guarantee that what’s encoded in the software can’t be changed, and that in certain situations final judgment can be delegated to a 21st century court system.

And as we move towards an AI-infused world, it’s also likely that different AIs and smart objects will need structures to interact with each other.

As you can see, the amount of innovation that Aragon can unleash is limitless.

Helping Aragon for me means helping move the world towards what it should actually have been for a while already, and I couldn’t be more excited to join the Aragon Association as its first Executive Director.

The Aragon Association’s mission is to ensure the development of the Aragon Network. Specifically, this means managing its treasury and funding teams to build out the core parts of the ecosystem.

We already have two teams building on it, and are looking for more.

You can think of this role as a temporary overseeing of the Association’s activities and treasury, while we figure out how to render it completely irrelevant (like every other physical jurisdiction-bound paper-based legal entity) and transition all of the governance to the Aragon Network itself.

I will be hiring a small team to make sure all of this happens, so if you are as excited as I am about the potential for decentralized organizations, you should reach out.

Additionally, we are organizing the first ever Aracon in Berlin in January, and that’s the perfect place to come learn about how organizations will work in the future and what you can build with Aragon today.

Transparency disclosures: I own ANT from the original token sale, which I never touched. I will be receiving a (small) amount of ANT as part of this new role, and I have also been buying some ANT off the market recently.

I will continue my investing activities, which include investing in European venture capital funds for a family office; in impact deals as an angel investor; and in in teams building the future of decentralized computing through Semantic Ventures as a venture partner and advisor.

I will also continue writing Token Economy and organizing Unplug.vc events.

Announcing the 2018 Summer Unplug Retreat 🏔

Plus a recap from our amazing 2018 Winter edition

Last March we hosted the 2nd edition of the Unplug Retreat.

The first one was a summer hiking one (pics and video here), and so we decided to try a snow-filled adventure this time.

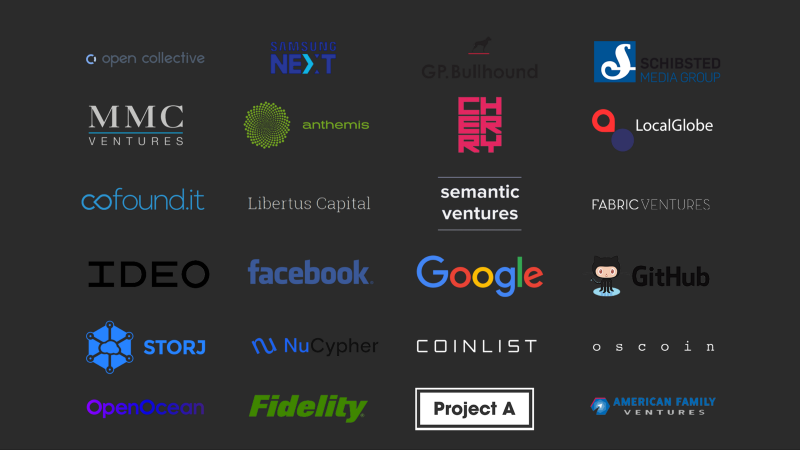

We invited some of the brightest minds in the European scene (as well as quite a few US adventurers!). They hailed from the following funds and firms:

There was skiing.

There was sledging.

There was snowshoeing.

There was sauna time.

And there were a lot of food, drinks and discussions.

So, with such an amazing experience it was a bit daunting to come up with an even better 3rd edition, but we think we made it!

🏔 Introducing the 3rd Unplug Retreat: 2018 Summer Hike edition

When: Sept 12–14th (after ETHBerlin)

Where: Madonna di Campiglio, Dolomites

Following from our 1st edition, this year we are going to bring you to one of the most beautiful places in all of the alpine region: le Dolomiti di Brenta.

We have chosen a truly representing alpine hut, built in hand carried stone and wood, fully remodeled but with its original 100+ years old floors and walls.

We will also be hosting you in a 4-stars superior hotel in Madonna di Campiglio, which is often referred to as “the pearl of the Dolomites”.

The hike is magnificent, and when you do it with 100 other investors and entrepreneurs, it has a different flavor.

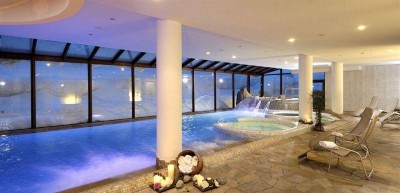

We will also have one of the biggest spas of the entire Dolomites at our disposal, Yoga teachers, professional astronomers, and licensed mountain guides.

The food will be top notch, and we promise the company will be as well.

Some more pics to get you excited. Applications are open now.

You can apply to attend at http://unplug.vc! We can’t wait to see you!

Image gallery from the 2018 Winter Unplug

Announcing Unplug and the 2018 Winter Venture Retreat

Last September, together with a good friend, we organized the first edition of the European Venture Retreat.

It was a crazy experiment, that we organized on a whim. And we had an amazing time.

You can see the video of the event here:

and some select pictures here:

(You can see the full album on Facebook)

We had people come from almost ALL of Europe, including Malta, Romania, Finland, Spain, Switzerland and so on, representing a lot of top EU funds and many crypto organizations like Placeholder and Aragon.

People got to chat while they climbed the mountains, while they enjoyed traditional food and while they slept in 12-people rooms in their bunk beds.

It was a different experience from the usual conference, and we were really glad to hear that people really enjoyed it.

So we’re doing it again!

With Lorenzo, we decided that the experiment was successful and we’re going to continue to organize epic mountain retreats for investors and entrepreneurs, and maybe even more people.

The goal and spirit is very much the same as the first edition:

- bring high quality people in a natural setting and let nature and its activities create bonds between them

- unplug from the daily hustle and refocus on what is really important

- get exposed to different opinions and ways of thinking, and bring it all back with you

Our good friends at Belka have also designed us a new amazing website that embodies what we want to do.

2018 Winter Venture Retreat

We have designed a truly epic, 3-day adventure near Canazei in the Dolomites.

We will have bonfires,

epic skiing,

stunning private SPA sessions

snowmobile trips

night sledding

and lots, and lots of amazing food

all in our own PRIVATE hotel

You should really sign up for an invite at unplug.vc, we hope to see you soon!

We need more public due diligence for ICOs

It’s a new world out there.

As investors, we’ve been used to a private fundraising framework that is being completely turned upside down by the public token sale mechanism.

As a venture investor, evaluating investment opportunities is often your full-time job and decisions impact your career as well as your wallet.

As a venture investor you’re also always given access to a lot of detailed confidential material and the access to the team, in order for you to ask questions. And even if in Silicon Valley deals close in record time, and at the seed stage you have to move fast, for Series A+ you have basically as much time as you want to make an investment decision.

Often, as a venture investor you’re also given information rights and sometimes board seats (even thought we’ve recently seen in many companies that in terms of preventing bad behavior these are fairly useless).

In the ICO world, that’s not the case.

Companies, teams or organizations that lunch public token sales, most often never interact with the final token buyer, and the average token buyer has no way to contact the team other than Twitter or their community tool of choice.

On top of that, ICOs are often on extremely tight deadlines, and are surrounded by a lot of hype.

It’s also usually more technically complicated to due diligence such efforts as code is law, and to fully appreciate what’s going on you need to read and understand the smart contracts behind an offering or the code behind a new protocol.

Given that the fundraising efforts are public plus there is little info and little time, I do believe the diligence efforts should be public as well.

When venture investors see deals they don’t like for some reason, or terms that are not fair, they just pass on the deal, and that’s it.

Because other investors will still be full-time investors that will go through the same process of analysis and diligence, and someone might like the deal. (Oftentimes VCs also interact offline about specific deals to get feedback and ask for things they might have missed, especially in advanced diligence).

In a public fundraising deal, even if reserved for accredited investors in the first phase (the token will reach exchanges sometime), investors aren’t usually full-time professional token investors.

Not everyone has time to dig into whitepapers (let alone understand them) and token sale economics to make a very informed judgment.

Yesterday, I did such an effort given no one would write about it. I wrote my sentiment on the token sale economics of Filecoin.

What has surprised me the most, is that aside from a few notes of dissent and criticism, there has been an overwhelming and amazing reaction online.

This post seems to have changed the perception of the token sale for people, which must mean that they did not know the facts presented in the post. This in interesting because those facts were just hiding in plain sight on the token sale documents. In turn, this means that people are very prone to the hype machine but not many have the time to actually go read and ponder about specific token sales.

This is wrong. But to me it should hardly be surprising: I certainly participated in a few token sales where I did not have much information or insight!

I would surely have loved if someone reported on what they found in the docs (and even more importantly the code) for other projects.

I would have loved if Emin Gün Sirer had started the public conversation with The Bancor Protocol before their token sale had started and I’m sure many others would have as well.

Please,

If you do spend your time looking at projects in the distributed ledger space, please write up your conclusions on projects you understand.

The analysis Filecoin doesn’t want you to read

Digging into the dynamics of Filecoin’s token sale and economy

Filecoin could be a game changer for the crypto space. It’s one of the few projects that are extremely well thought out, built by an amazing team, and actually needed.

Add to that the fact that they created a new proof mechanism and have a legitimate need for a blockchain.

In other words, it’s probably the best that the crypto community has seen recently. It was certainly one of the few ones I was looking forward to.

But then, two things happened:

- they released some info on the token sale.

- they released some more info in response to anonymous questions from an investor.

Man, I wouldn’t have expected something like this from a solid team. The response felt particularly disingenuous.

I’m now incredibly disappointed, and probably will not participate in the sale.

I’ll also probably lose a good number of friends that are investors in the company and/or pre-sale, but in this new era of completely public fundraising, I think the public deserves to hear it from all sides.

The flaws in Filecoin’s token sale

- Filecoin gave an amazing deal to their buddies, just a few weeks ago

- Filecoin is being insanely greedy, going out for a $700M+ raise

- Early clickers are incentivized, price unknown, network congestion update, see below

- Protocol Labs and Filecoin foundation are keeping 2x the coins that investors will get

Problem #1: Filecoin gave an amazing deal to their buddies

There’s nothing that can stop them here, but many people got very mad about this and rightly so.

Filecoin raised $52M in an advisor sale very recently, till July 24th. This sale was reserved for people close to the company and in the industry. Many extremely high profile people participated, total cheques were 150.

These investors paid a maximum of $0.75 per coin. They could also have chosen discounts based on the amount of time the coin would vest, from 0% to 30%.

These investors did not take any more risk than the investors who are going to participate in the public token sale. Actually, one could argue that they even took less risk because they knew what the price would be all the time (which is not going to be the case for public investors)

Their explanation:

All of these people and organizations (a) have been working hard with us for years to make IPFS and Filecoin successful

This is absolutely untrue. Quite a few people just got introduced to the team recently and got into the sale just a week ago and paid the $0.75 price.

(b) have fully committed themselves to work hard with us and for the Filecoin Network for many years to come,

Sure, but you, dear reader, would commit too, wouldn’t you?

c) offer tremendously valuable advice, hands-on help, knowledge, skills, resources, connections, and more.

This is the real reason that they will pay 2x-20x less than you. You be the judge. Usually vested equity is subject to good behavior, but here anyone could promise great advice and help and then disappear, but still get coins.

Problem #2: Filecoin is being insanely greedy

After having raised $52M in a pre-sale for a pre-product offering, they want to go out and raise an amount that is effectively uncapped.

Their response:

Our token sale IS NOT uncapped. It is capped in terms of the amount of Filecoin sold: 200M FIL.

Over the last few years, Protocol Labs has proved to the world that we know how to deploy capital to create valuable projects, valuable technology, and valuable software. To date, all of the work you see — IPFS, libp2p, IPLD, Multiformats, Filecoin, CoinList, and all our research — all our work has been funded by under $3.5M. We know how to deploy capital effectively.

It seems like I’m reading a Trump statement. Basically saying: “I have eaten 10 ice creams in the past years, so I’m great at eating ice creams and can easily eat 1000 in the next few years. Gimme ice creams.”

But aside from the absurdity of trusting someone that deployed $3.5M with $500M+, let’s analyze the USD cap of their token sale.

Some numbers

- $52M raised in presale

- Minimum 69M, Maximum 99M Filecoins sold in ICO

- Advisor max price $0.75

- 131M-101M Filecoins left for the public

- Starting ICO price: $1.3 ($52M/40M), almost 2x advisor price.

- Price at $100M raised = $2.5

- Price at $200M raised = $5

- Unfortunately, their price function is not clear. It doesn’t state if a transaction amount impacts the total raised before calculation of price or after. In any case, assuming normal average investments, eg. $100k, this doesn’t change much.

- The USD cap will change based on the average purchase amount and the average discount chosen by the buyers.

Let’s calculate the Filecoin ICO USD cap

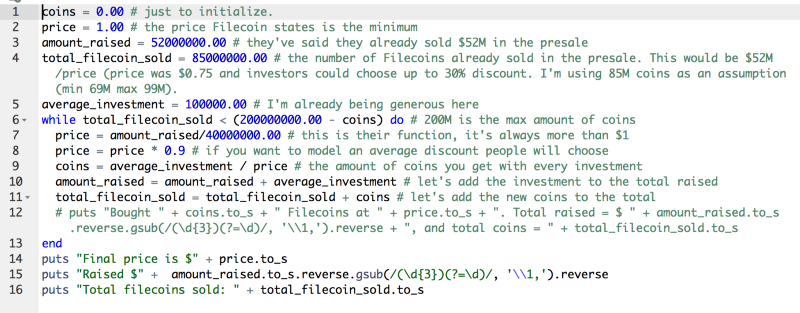

I wrote a small piece of code to calculate the USD raised with different assumptions.

You can see it here:

https://gist.github.com/stefanobernardi/d6eda1fb299d0832c3dad71a5a4fcd20

And you can run it here on the amazing Repl.it (Mission and Market portfolio company plug! Oh BTW, I deployed $3M with my first fund, maybe I should raise a $1B second fund.)

Assumptions:

- Total Filecoin sold in the advisor pre-sale: 85M (The minimum sold is 69M, if everyone paid $0.75, and the max is 99M, if everyone chose a 30% discount, so I chose something in between)

- Average investment = $100,000.00

- Average discount chosen by investors: 10% (discounts are 0%, 7.5% for 1y vesting, 15% for 2y vesting, 20% for 3y vesting — I’m assuming many will choose 0 and a few will choose the rest, so 10% sounds about ok.)

The results

Final price is $15.54075

Raised $690,800,000.0

Total filecoins sold: 199999826.3440984

So effectively the cap of Filecoin’s ICO is ~$700M.

For fun, let’s assume no one chooses discounts:

Final price is $34.34

Raised $1,373,700,000.0

Total filecoins sold: 199997793.51623443

The real cap is $1.37B.

And, everyone max discount:

Final price is $7.83

Raised $391,600,000.0

Total filecoins sold: 199991567.59900582

Highly unlikely, but this is the minimum possible cap.

Call me old fashioned, but wanting to raise half a billion dollars for a pre-product endeavor is absolutely fucking insane.

Let’s remember that the tokens will also come out when the network is launched, which Protocol Labs is estimating at 1 year out. Vesting will only start then.

Problem #3: Early clickers are incentivized, price unknown

Given the price grows as more money is invested, early clickers are incentivized to get in as fast as possible — this has the obvious intention of raising as much money as possible.

Users paying in BTC and ETH will also have to wait for their transactions to confirm before knowing how much they paid. Given a very likely clogging of the network, this has the potential for disaster.

I suggest reading their explanation in the response. It is a mix of funny and scary.

Update: rules have changed. Price will be averaged in the first hour and max price in the first hour is $6.

This means that no one will pay the $1.31 min price and buyers in the first hour won’t know how much they’ll pay in the $1.31-$6 bracket.

When the first hour is over, that’s when people will want to fast click because they’ll have information about the price and total raise.

This update just makes it so that there won’t be any price difference for first hour clickers, which is good, but not great. Price is still unknown (and crazy high compared to advisors).

Problem #4: Protocol Labs and Filecoin foundation are keeping 2x the coins that investors will get

This is absolutely mind-boggling to me.

To compare, the ETH genesis sale gave 10% of ETH minted to early contributors and 10% to the Ethereum foundation. 80% was for investors.

In Filecoin’s case, Protocol Labs will receive all the cash PLUS 50% more coins than investors, so 1.5x. A foundation will receive 50% of the amount of coins “minted” by investors. Total: 66.6% to them, 33.3% to you.

Assuming a “small” $250M total raise, Protocol Labs and a foundation would receive, $250M cash, plus $250M-$300M (remember, the discounts?) in tokens.

Also, 70% of the tokens that will ever exist will be mined. This means that the investors are only getting access to 10% of the total supply ever.

As a comparison, Ethereum sold 60,108,506.26 ether at genesis, and today there are 93,775,666.

Place your bets accordingly.

…

Quick and dirty utility value calculation

Edit: I’m removing this as apparently it was way off. I’ll try to spend more time, but with token sale in just a few days not sure I’ll be able to, so prefer to just take it off.

All other points I still stand by.

Conclusion

Filecoin is why we can’t have nice things.

A real game changing project, that has always touted they care about the community and would do this for free, is going out trying to raise $700M and keeping double that in coins.

I think this could be one that will be remembered and written in history books about how insane this all was, and how a major innovation like the cryptographic token was taken advantage by people wanting to raise stupid sums of money, before it was really used to the best of its potential.

Thanks to redacted, redacted, redacted, redacted, and redacted for providing feedback on this draft, the ideas behind it, the code and the assumptions for the utility value.

Announcing the 1st edition of the European Venture Retreat

A full weekend to unplug in the Dolomites with awesome people

About one year ago, I moved from San Francisco to northern Italy, close to the Dolomites.

When I was a kid, my parents used to bring me in the mountains to get nice fresh air for a medical condition I had. Since then I’ve been in love with the colors, the smell, the air, the physical activity, the sports, the views, and the culture of the mountains.

Now, I am fortunate to live all of this every single day. And it has helped me immensely to reduce stress, focus more, and think about what is really important for me and my family.

When I was in SF, one of the events I enjoyed the most was Camp YC, a weekend in the woods organized by Y Combinator. I loved the fact that it had a lot of unstructured time and that you could chat with fellow entrepreneurs around a campfire.

Given I can’t attend Camp YC anymore, and I want others to enjoy all that I’ve been having for the past year, I decided to organize something like it over here.

And so, the European Venture Retreat idea was born.

What is it?

The European Venture Retreat is an invite-only weekend-long retreat in the Dolomites, with 70 investors, entrepreneurs and generally very interesting people.

Is there a website?

Of course there’s a website.

When is it?

September 14th-17th, 2017

Is it a conference?

Definitely not. There are no big keynote speeches or workshops or panels. I’ve grown pretty tired of all the usual formats.

This is a weekend to unplug. It’s more like a vacation with a bunch of really interesting people.

But most of all it’s a way to create more meaningful relationships than the ones you can create at a conference.

So if it’s not a conference, what’s the agenda like?

The main activity will be hiking, and exploring the mountains. We will also have additional activities like night-time sky exploration, yoga and meditation.

We will have a lot of relax time that will be spent to forge deep relationships with the other participants, the ones that you create when you share a room in a mountain hut and share meals.

We will network and we will also have some mini-talks if the participants are interested.

Is this a luxury 5-stars event?

Absolutely not! This is a mountaineering expedition.

It’s the most spartan event you’ll attend this year, guaranteed.

We will be in a mountain hut at 2.440m with all logistical consequences: hard to get water, little space.

We will be sharing rooms (2 people the first night, 4–8 people in the refuge), and will have two tokens for showers (use at your own discretion, or sell them to others! Probably won’t have time to create an exchange so it’ll have to be OTC 😂)

It will be cold outside and it will be tiring to get to the refuge. You should only attend if you want to experience a mountain adventure.

Who’ll be there?

We have invited a wide spectrum of participants, with a focus on VC investors, angels, and startup founders.

I don’t think the #1 reason to come should be if there’s a celebrity VC or founder, as I think the best and most fruitful relationships are created with unexpected people. All I can guarantee is that the people will be extremely interesting and diverse.

We don’t want to have 2–3 rockstars and have all the attention focused on them, and have their and everyone’s experience be terrible. We want to create bonds that wouldn’t have been created otherwise.

I personally prefer to chat with people that are still hungry and interested in weird things, and that has also the benefit of creating a much more future-proof network.

But, we can share that we have many YC founders as well as participants from the following funds:

There will also be a solid presence of people interested in crypto-currencies.

Where will it be held?

See that small red-roof? That’s the TierserAlp Refuge, at 2,440m.

Promise it’s awesome.

How fit do I have to be?

You just need to be able to do a 2.5h hike to get to the refuge. We’ll break into multiple groups if people want to go faster / slower.

Kids can do it, but it is tiring.

How do I get an invite?

You can request an invite here.

Logistics

- We leave from Verona at 2030 hours on Thursday evening.

- We’ll sleep in a hotel at the base of the mountain the first night.

- We’ll hike to the refuge Friday am to get there by lunchtime.

- We descend Sunday am, eat in a local place and aim to be in Verona by 5pm.

Plan travel accordingly!

Pricing

I’m pretty proud of the fact that we have managed to keep the event at an amazing €389 price for early-birds. Price jumps to €499 for late tickets, if there will be any.

I’ve seen one-day events where you pay thousands of dollars, and come back with the same old boring stack of business cards and nothing more in your life.

Here, you’re just paying for your accommodation, travel and food expenses. You’re not paying anyone’s flight and luxury pre-conference dinner and most certainly a yearly salary to me (although BTC donations are welcome 🤑).

What’s included?

- 3 nights accommodation

- 3 breakfasts

- 3 lunches

- 2 dinners

- Travel to-and-from Verona

Ask for an invite now.

We are on a tight timeline and tickets will sell out soon. Ask for an invite here.

Unfortunately space is constrained by the capacity of the mountain hut, so we can only extend so many invites. Sorry in advance if we can’t accomodate everyone.