We’re living in the most innovative and fascinating period of history

I’ve had this nagging feeling for a while.

I didn’t really know what it was, but it surely had to do with the insane scale of amazing new fields and opportunities that I have an interest in.

I find it hard to keep track of everything and especially to become an expert in any of those fields.

And then I succumbed to the idea that the acceleration of commercial-ready technology is just unmanageable for a single individual.

When the internet first showed up, it was really (I think) the only massively disruptive technology to show up after the transistor/computer.

But now, we live in the most exciting period of human and technological history and our progress is accelerating so fast, fueled obviously by the internet’s orgy of ideas, that so many more technologies have reached the phase where they can be deployed commercially and have the potential to change things as much as the internet itself.

This means that for every new sector, there is a specific community getting formed with people who are dedicating their life’s work to that specific field and developing deep insights and experience.

At the same time, there are innumerable startups being born in every field, and (from what I can remember) this represents a couple orders of magnitude more than the number of early startups in the internet, even compared to just 8–10 years ago.

With Mission and Market we’ve been lucky to invest in many of these sectors and I’ve been fortunate lately to have the time to study more in depth some of them. And to me, each one of the fields I list below represents an unmeasurable amount of opportunities.

But my brain is now tied in this constant dilemma, and I think it’s one that every VC or angel will have to come to terms with at some point:

should I try to keep track of all of it or should I just choose one and focus on that?

I don’t really have an answer yet, and for now I’m trying to keep my interest open to all of them (and new ones that keep on showing up!) but I’m not sure how long I’ll be able to continue doing that.

This goes back to the rise of the thematic / vertical VC fund, which I wrote about 3 years ago (oh man, time flies).

I think we’ll end up seeing even more of these funds and I think they will produce very decent if not above-average returns, given that now each vertical has the potential for multiple breakthrough companies.

Another point to briefly touch on is the value-add a generalist investor like myself could ever hope to bring to a very specific company in a new field.

Ron Conway and others have been made famous by their decision to focus exclusively on internet investing in the very early days (and have been awesomely rewarded for that), but now there are 10 new internet-like fields.

Will everyone who focused on one be rewarded like them? Will one field completely outdo all the others? Will investors just have to embrace all of them?

These are the questions that keep me up at night, and I hope to discuss them with many of you.

$(X) is the new internet

This is my personal list of fields that I think have a similar impact potential to the internet. It doesn’t take into consideration fields which I think have massive opportunity but not to that scale (eg. cybersecurity) or some that have already demonstrated that (eg. mobile) or some on which the jury is still out (eg. cleantech, which probably merits a discussion of its own).

Deep Learning is the new internet

The things that we’ve been able to achieve with deep learning in just a few years have been astonishing. For me, it’s definitely the most interesting part of machine intelligence.

Deep learning changes everything. It enables us to spot answers to questions that we dare not even ask just a few years ago and also create things which would have been impossible just a few months ago.

If we add other aspects of machine learning and, specifically, generative AI — the mind is blown away at every single new piece of information I gather on the space.

We’ve been fortunate to invest in Atomwise (finding new drugs thanks to DL), Enlitic (spotting lung cancer with DL) and Floyd (making it easier to run DL processes) — but there are SOOO many more that I’d like to be involved in and SOOO many more I’ve never even heard about.

I’ve also invested in a Deep Learning-specific venture fund with which I hope to get more exposure to the space — but I think DL will be so pervasive that I can never get enough exposure.

Blockchain is the new internet

I’ve recently seen a tweet by Joel Monegro of USV which clearly encapsulates my own thinking.

Web is boring. Blockchain is interesting.

— Joel Monégro (@jmonegro) March 11, 2017

The blockchain is really the first major disruptive computer science technology to come around that was entirely unexpected and has the potential to change everything.

I’ve been fortunate to know about Bitcoin since early 2011 (less fortunate to turn off my mining machine right after as it was about to boil) and have been following the space ever seen.

I now own a dozen different cryptocurrencies and have read probably triple that in whitepapers describing different decentralized applications (dApps) and currencies.

I’ve made (digital) money on some and lost (real) money on others, but the level of experimentation and excitement that is seen in the blockchain space and community in unrivaled.

Many paradigms are being completely redefined by blockchain technology. Decentralization is a really big force and I can’t seem to see an end to its advancement.

Finance, healthcare, manufacturing and more industries will ask themselves how they operated without the blockchain — just as we ask ourselves today how we operated without the internet.

Synthetic biology is the new internet

The amount of innovation happening in synbio is astounding. It is finally all within reach of “normal” entrepreneurs and outside of big University research labs.

We’ve been lucky to look at many deals in the space and even invest in some.

It is abundantly clear that the future will be powered by synthetic biology. So many aspects of it that we can’t even imagine.

Materials will all be fermented or grown, as will all sort of different food elements, especially animal-based food.

It will seem just absurd that we were wasting the Earth’s resources as well as breeding and killing billions of animals every year.

The economic value of old-school industrial production that is being impacted is incalculable and we will see the new Rockefellers in this field.

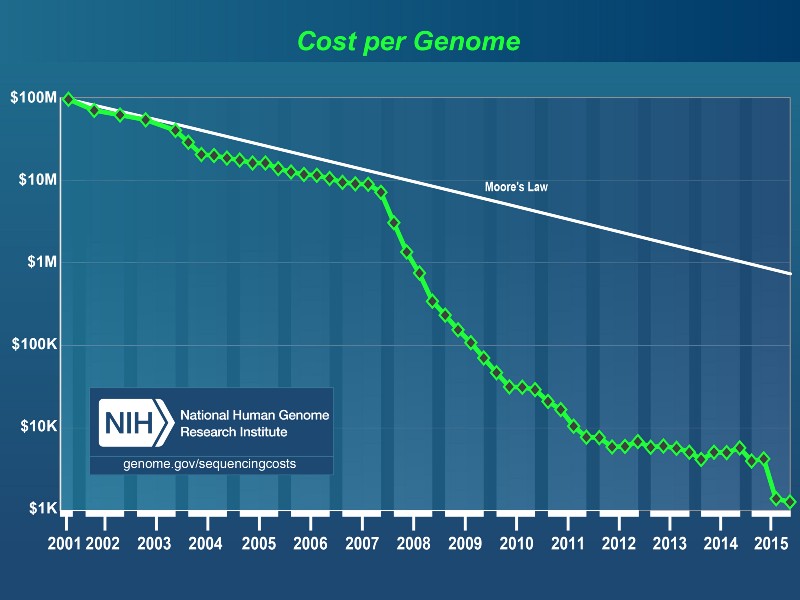

Genomics (and microbiomes) is the new internet

This image should make everyone insanely excited. For the first time in history we’ll be able to understand how we’re made and why we do some of the amazing things our bodies make us do.

With RNA sequencing, and microbiome understanding, we can even monitor our bodies responses in real-time to various diseases and drugs. We’re investors in the pioneering RNA sequencing company and we’ve seen the future. It is amazing.

But it doesn’t stop at understanding.

With CRISPR-Cas9 we can actually change our DNA and impart new instructions. This is just mind-blowing. We’ve been small investors in Caribou Biosciences (thanks AngelList!) and we feel like we’re watching the future unfold.

The advances being enabled by CRISPR are still pretty incomprehensible but we are seeing more and more entrepreneurs using this tool, as well as developing parallel tools (DNA cell delivery, etc.).

It’s a new world.

Robotics is the new internet

We’ve all seen Boston Dynamics’ videos of their andro-dogoids and we’ve all been amazed / scared.

The reality is that robotics is today way more advanced than we thought. Just walk in a factory anywhere in Europe and you’ll see robotic arms and other autonomous systems.

Slowly we’re automatic all the repetitive tasks.

We routinely see videos of cars and trucks being driven by themselves.

Autonomous hardware systems are beginning to become a whole new sector with a vast amount of applications (and already many $B exits).

As software and materials become cheaper, we’re going to see many more of these companies. And when we’ll have billions of robots deployed, the opportunities for companies will be endless.

IoT is the new internet

I haven’t followed the IoT revolution as much as I wanted, but it does feel like another field which is slowly becoming a massive platform and opportunity.

I don’t think we can really understand the impact of receiving data from and being able to interact with trillions of objects in real time.

Unsexy maybe, but still revolutionary.

Voice technology is the new internet

Most of you will have an Alexa in the house by this time. We have a Google Home and even if it’s not loved by all, conversational software enables a host of new use cases and thus many new potential companies.

It feels like this is a game reserved for the big ones, but I believe there will be a wide interest from startups and we’ll see some tools that will become comparable to our best friends in the future.

Voice, like all the other areas listed here, is a completely new platform — and will see very specific apps that couldn’t be built anywhere else.

3D Printing is the new internet

3D Printing is yet another completely different area that is a platform onto itself.

It basically brings all of the advantages of the internet to physical things.

Sure, it might still be very early, but the potential is clear and massive. I think it’s really incalculable.

The ripple effects of a usable and economical 3D Printing revolution would change the world as we know it, and enable a myriad new companies.

VR/AR is the new internet

I truly think that in the next years we will spend as much time in VR as in the RW.

We’ve already seen the first few $B exits in this space and it’s just the beginning.

The promise of companies such as Magic Leap just compound this even more.

I think in 15 years we will not have computer screens anymore and will think that they were the most limiting aspect of modern life.

“Do you remember when you could only see what was on your small little screen? LOL”

Clearly opening up a new world, opens up a whole new economic paradigm too. We need everything new in VR. Operating Systems, networks, games, productivity tools, and even more of what we can do today on the internet. Sure some will be just moved over by internet companies, but many VR-native companies well be born — and they will be huge.

We can see this thanks to our investments in FOVE and Limitless, which is redefining how we create experiences in a VR-native fashion.

What am I missing?

I’m sure there are a few other fringe areas that have the potential to be platforms of massive change (microfluidics? nanotech? alternative currencies?).

Let me know where I should be looking at 🙂

Thanks to Yannick Roux for reading a draft of this post.